Foreclosure Prevention

Posted on: April 7, 2020

Foreclosure Prevention FAQ

The information provided on this post does not, and is not intended to, represent legal advice. All information available on this site is for general informational purposes only. If you need legal help, you should contact a lawyer. You may be eligible for our free legal services and can apply by calling our Covid Legal Hotline at 1-844-244-7871 or applying online here.

Current as of September 28, 2020.

![InkedForeclosure Chart 2 (1)[5234]_LI_AE](https://slls.org/wp-content/uploads/InkedForeclosure-Chart-2-15234_LI_AE.jpg)

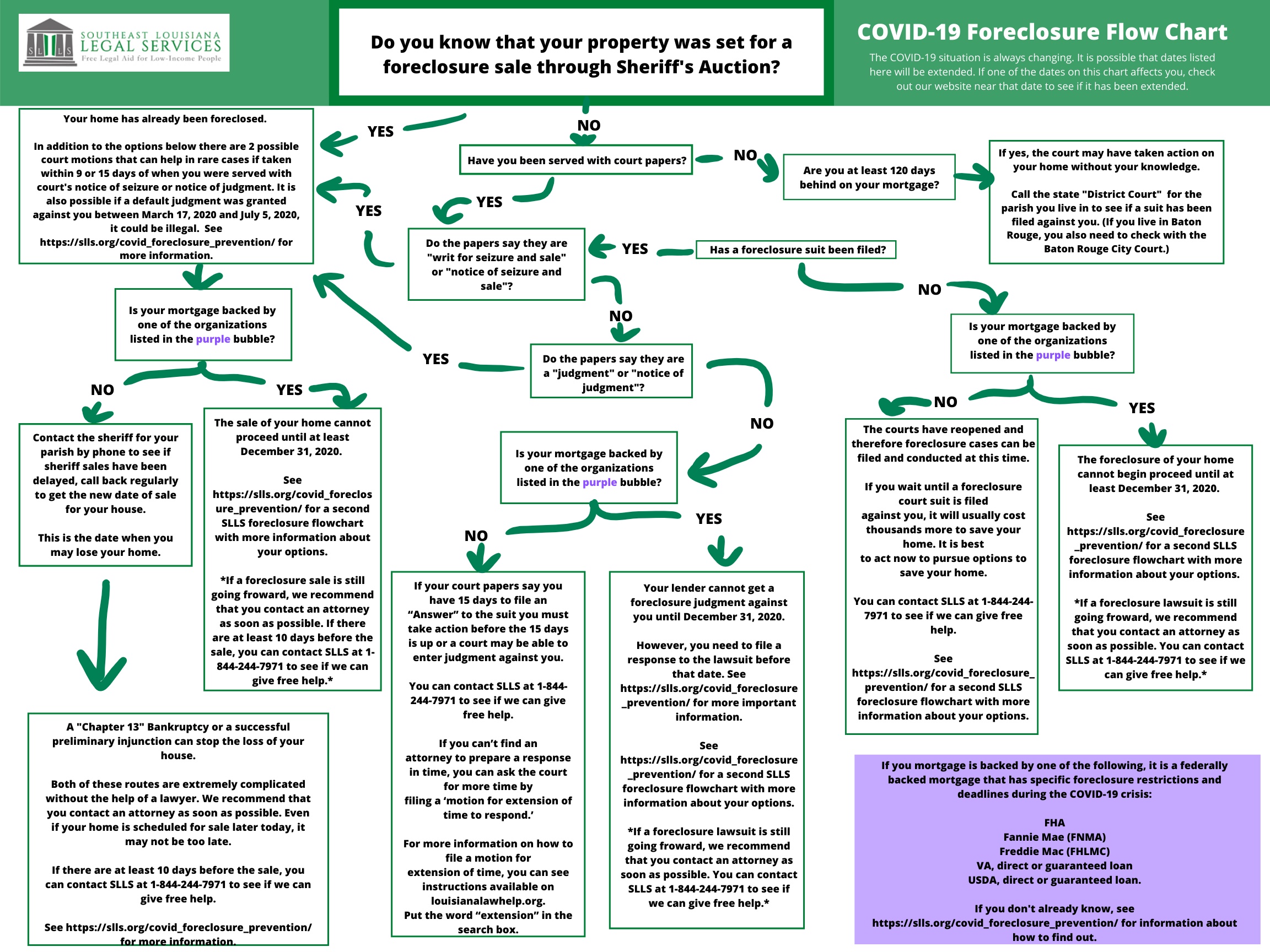

1. I cannot pay or am behind on my mortgage, but have NOT been served with court papers, can my lender foreclose on me during the COVID crisis?

(If you missed the sheriff’s attempt to serve you, there could already be a foreclosure judgment against you. See the question about having missed service, further below.)

If you wait until a foreclosure court suit is filed against you, it will usually cost thousands more to save your home. It is best to act now to pursue options to save your home.

The courts have reopened and therefore foreclosure cases can be filed and conducted at this time. You can call the state “District Court” for the parish you live in to see if a suit has been filed against you. (If you live in Baton Rouge, you also need to check with the Baton Rouge City Court.)

If a foreclosure suit has been filed, it is better for you to find out and be involved in the suit than to just let the court issue a judgment against your home. See the question below for people who have a foreclosure court case filed against them for more important information.

However, if your mortgage is under any of the following federal programs, your lender cannot start or proceed with a foreclosure until at least December 31, 2020:

- FHA

- Fannie Mae (FNMA)

- Freddie Mac (FHLMC)

- USDA direct or guaranteed loan

- VA loan, direct or guaranteed loan

If I am not sure if my mortgage is with one of the federal programs above, how do I find out?

- You can look for this information in all the papers you received when you went to closing on the loan (e.g., the documents you received when you signed the mortgage and mortgage note when you first got the loan), or

- You can also call the federal programs directly to check at the numbers below:

- FHA - 1-877-622-8525

- Fannie Mae (FNMA) - 1-800-2FANNIE (1-800-232-6643)

- Freddie Mac (FHLMC) - 1-800-FREDDIE (1-800-373-3343)

- USDA direct or guaranteed loan - 1-800-414-1226

- VA loan, direct or guaranteed loan - 1-877-827-3702

Also see the section below about help in paying your loan.

2. I missed or avoided the sheriff who is trying to serve papers. Is my home safe?

No. If you are far behind on your mortgage, a court suit could have already been filed.

If the sheriff missed you for service several times, the court may have appointed an attorney to accept the court service for you, and the court can or may have taken action without you knowing about it.

You can call the state “District Court” for the parish you live in to see if a suit has been filed against you. (If you live in Baton Rouge, you also need to check with the Baton Rouge City Court.)

If a foreclosure suit has been filed:

- It is better for you to find out and be involved in the suit than to just let the court issue a judgment against your home.

- If you act before the court appoints an attorney to accept service for you or they start to work, it may also save you from having $500 or more added to what you owe on your house.

- See the question below for people who have a foreclosure court case filed against them for more important information.

3. Can I get help to afford my loan?

You can ask your mortgage company to “work with you” to extend payments or for a repayment plan:

- You should be careful about understanding the terms of any forbearance (e.g., delay in payments), extension, or option if you are granted one.

- Some forbearances move payments to the end of the entire loan period. (For example, after the entire remaining years of a 30-year mortgage term.)

- Others require immediate payment of the delinquent amount at the end of the delay. (For example, immediately after the 3 or however many months delay that you get.)

- You should keep written proof from your lender of any forbearance agreement.

If your mortgage is with one of the federal programs listed above:

- You can request a forbearance (e.g., delay in payments) by submitting a request to your mortgage company explaining that you are having money problems due to the COVID-19 emergency.

- Contact your servicer to see how they would like you to submit your forbearance request. We recommend submitting your request in writing and keeping proof of your submission for your own records.

- Under the CAREs Act you may request this forbearance at any time during the “covered period.” However, the CARES Act does not define the covered period. It should last at least the duration of the COVID-19 emergency declared by the President on March 13, 2020.

- However, if your loan is under the FHA or USDA Guaranteed Loan program you must submit your application for the initial 180 day forbearance period by October 30, 2020.

- On receiving your request for forbearance, your mortgage company is required to delay your payments for 180 days.

- You can request up to another 180 days during the COVID-19 emergency.

- You can later request that the forbearance be shortened.

- No fees, penalties, or interest beyond normal can be charged when your payments are made on time and in full on the new schedule. Normal interest will still be charged during the period.

- These federal programs each have more options, too, that you can apply for to help avoid foreclosure. Consult your mortgage company about other options such as a repayment agreement or a loan modification. However, there is no guarantee you will be offered something or that it would be affordable for you.

If your mortgage is NOT with one of the federal programs listed above:

- Some mortgage companies may still allow you a forbearance period due to financial hardship even if just a month or two. Sometimes they might not collect interest, due to the COVID-19 emergency.

- This must be requested directly, often in writing, from your mortgage company.

Depending on your finances, filing a Chapter 13 Bankruptcy could stop any foreclosure and extend your payments. However, once the Bankruptcy repayment plan is in effect, your monthly payments will be higher than under your original loan. You should seek the advice of an attorney about filing a Chapter 13 Bankruptcy, as a bankruptcy is a complicated legal proceeding that would be very difficult to manage without the help of an attorney.

To see if you can get free help dealing with repayment options to save your home, you can call Southeast Louisiana Legal Services to see if we can offer free help. You can apply for services by online at https://lastate.kempscaseworks.com/server/shared/a2jviewer.htm or by calling one of our offices.

- Baton Rouge: 225-448-0080

- Hammond: 985-345-2130

- New Orleans: 504-529-1000

All numbers listed lead to the same few attorneys; only call one.

4. I have been served with court foreclosure papers. What do I need to do?

This depends on what the papers say.

If your court papers say they are a “writ for seizure and sale” or “notice of seizure and sale":

- The court has already ordered the property be sold at sheriff sale.

- You can appeal the foreclosure order within 15 days of when you were served with this paperwork. However, these appeals are expensive and most people cannot afford them. If you would like to try this option, we recommend that you talk to a lawyer immediately.

- You should contact the sheriff for your parish by phone immediately to find out the date of the sale. This is the date when you may lose your home. See Question 5 “My property was already set for a foreclosure sale through sheriff’s auction.” for more information and your other options.

If your court papers say you have 15 days to file an “Answer” to the suit:

- You must file an Answer or ask for an Extension of time to Answer within 15 days of being served with this paperwork or a court may be able to enter judgment against you.

- Cases like this can require a lotof work or preparation. You should consider applying now for free legal help to save your home using the internet site or one of the phone numbers above.

- If you can’t find an attorney to prepare a response in time, you can ask the court for more time by filing a “motion for extension of time to respond.” If granted by the court, you can get up to 30 extra days to properly respond to the suit. For more information on how to file a motion for extension of time, see https://louisianalawhelp.org/resource/a-motion-for-extension-of-time-to-respond-in-a-louisiana-court-with-instructions

- Your “Answer” responding to the suit should not just respond to each claim made in the petition. The help of a lawyer is important because certain defenses are lost if not included in the answer. Some are not direct responses to what the other side’s papers say. A lawyer may also help see if you have a case against the mortgage company that you can add to the suit.

If your court papers say they are a "Judgment" or "Notice of Judgment:”

- The court has already ordered the property be sold at sheriff sale.

- You can file a "motion for new trial" within 7 days from the day after the clerk has mailed or the sheriff has served you, the judgment or notice of judgment. If you would like to try this option, we recommend that you talk to a lawyer immediately.

- You can file a "suspensive appeal," an appeal that puts a hold on the sale of your home. If a timely motion for new trial was filed, the suspensive appeal would be due within 30 days from the court’s decision on that motion. The payment of a bond is required to file a suspensive appeal. Because of this, these appeals are expensive and most people cannot afford them. If you would like to try this option, we recommend that you talk to a lawyer immediately.

- *Please Note* A “default judgment” is a type of judgment giving the other side what they asked for in their lawsuit because you did not file an answer to contest their claims within 15 days of when you received their court papers. If your 15 days to answer expired between March 17th and July 5th, the time you had to answer was suspended until July 5th due to the COVID-19 emergency. If the judgment you received is a “default judgment” that was granted against you by the court between March 17, 2020 and July 5, 2020, it could be illegal. If you believe this may have happened to you, you should seek the advice of an attorney right away. You can apply for free legal help by calling Southeast Louisiana Legal Services at the phone numbers listed above.

5. My property was already set for a foreclosure sale through sheriff’s auction.

Any date listed on papers you received was subject to change. No one has to notify you if the date changes or changed. So regularly check on the sale date with the sheriff’s office.

Many parishes postponed foreclosure sheriff sale auctions due to the COVID-19 pandemic. However, these auctions have resumed. Contact the sheriff for your parish by phone to see if sheriff sales have been delayed and continue to contact the sheriff's office for your parish on a regular basis to check if a new sale date has been set to make sure you’re aware of when you may lose your home.

6. What do I do if I receive a notice from the court, a Justice of the Peace, or a Constable?

If you receive a notice from a court, a Justice of the Peace, or a Constable, you should seek the advice of an attorney. You can apply for free legal help by calling Southeast Louisiana Legal Services at the phone numbers listed above.