From the Executive Director As Black History Month draws to a close, we are reminded of the disproportionate toll the pandemic has taken on black families, hit hard by higher rates of COVID-19 mortality, eviction and poverty. A nationwide study found that black renters accounted for 32% of all evictions, while only being 20% of the renter population. The disproportionality is even more stark in our own caseload – 89% of our eviction cases are for people of color. While we can't always impact everyone who needs civil legal aid, we always fight for fair and equitable access to the legal assistance our clients need.

Thank you for your continued support in the fight for fairness.

Laura Tuggle Executive Director

SLLS Gives a Voice to Our Smallest Clients

Our Child in Need of Care (CINC) unit provides civil legal representation to children who have entered the foster care system, through no fault of their own, as a result of abuse or neglect by their parent or guardian. Our average CINC client is a first grader aged six and a half. CINC cases are often long and taxing, as our attorney's fight to achieve permanent stability and safety for very small children who have experienced significant trauma in their lives.

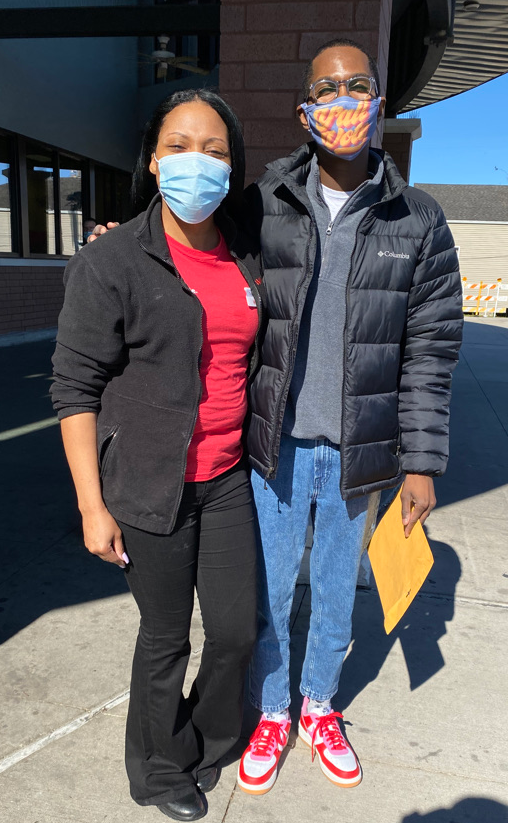

SLLS Delivers for a Struggling Tenant

SLLS Staff Attorney Zach Simmons and his client Ms. Parker Our recently launched Pro Bono Innovation Fund Security Deposit Theft Project is already delivering successes for our clients. Out of no where, Ms. Parker began receiving inexplicably high water bills. While she was able to get out of her lease and find a new place to live, her former landlord refused to refund her $1,000 security deposit, even though she hadn't caused any damage to the apartment. Zach Simmons, her SLLS attorney, sent a demand letter to the landlord requesting the full refund of her security deposit and a portion of the outrageous water bill. He was recently able to deliver the refund check for over $1,400 from the landlord to Ms. Parker on her birthday.

SLLS Partners with the Gillis Long Poverty Law Center to Fight Evictions During the Pandemic

We are excited to announce that we received funding for a second Gillis Long fellowship, focusing on tenants rights, in response to our increase in housing cases due to the pandemic. Chris Kerrigan, a recent Loyola graduate, is our project attorney.

Davida Finger, Clinic Professor & Associate Dean of Students, said "The Gillis Long Poverty Law Center is pleased to partner with SLLS on critical civil justice work including housing. The challenges renters have faced during the pandemic are tremendous. The Housing Justice fellowship is one way to increase representation and access to justice and bolster the important legal work that SLLS does."

New Report Finds that Civil Legal Aid Works!

A new report from the Louisiana Bar Foundation found that Civil Legal Aid Provides a 918% Social Return on Investment to Louisiana. For every $1 invested in Louisiana's civil legal aid services, programs deliver $9.18 in immediate and long-term consequential financial benefits. “We know best how to direct civil legal aid to have the most impact for Louisianans in need of legal help. Access to civil legal aid makes Louisiana’s communities stronger – schools, businesses, government agencies and the state all benefit from resolving civil legal problems,” said LBF Executive Director Donna Cuneo.

You can read more about the report here.

Tax Tips for Your Pandemic Payments

Tax season is just around the corner. Visit the SLLS blog here for important information how the COVID-19 Stimulus Payments and Unemployment Benefits may impact your taxes.

SLLS in the News

|

Updated February, 18, 2021

No. The federal government sent two rounds of stimulus payments to eligible individuals and their dependents under 17 years old. The first round was for $1200 for adults and $500 for eligibile dependents, and the second round was for $600. This is different from unemployment benefits you may have received. These payments are NOT taxable income, so you do not have to declare them on your 2020 return or pay taxes on them.

If you did not receive your stimulus payments:

If you have not received your stimulus payment, or believe someone else wrongly received your stimulus payment, you should electronically file a 2020 tax return now, claiming the credits for the stimulus amount.

Yes. Unemployment benefits are like wages, and you must report it as income on your tax return if you earned enough income to need to file taxes.

Yes. It is taxable income that must be reported on your tax return.

Volunteer Income Tax Assistance Program (VITA Program) https://www.unitedwaysela.org/vita

AARP Foundation Tax-Aide provides taxpayers 60 and older with low income with free tax help.

You can also go to irs.treasury.gov/freetaxprep to search for other free providers.

If you are filing your own taxes:

If you are having someone else prepare and file your taxes:

The SLLS Tax Clinic cannot electronically file your current tax return.

SLLS may be able to offer free help if you:

To apply for services, call Lynnette Tillis toll-free at (877) 521-6242, extension 225, or apply on our website here.

*Please note, our services are only available for residents of the following parishes: Ascension, Assumption, East Baton Rouge Parish, East Feliciana Parish, Iberville, Jefferson, Lafourche, Livingston, Orleans, Plaquemines, Pointe Coupee, St. Bernard, St. Charles, St. Helena, St. James, St. John the Baptist, St. Tammany, Tangipahoa, Terrebonne, Washington, West Baton Rouge, West Feliciana

The information provided on this post does not, and is not intended to, represent legal advice. All information available on this site is for general informational purposes only.

If you need legal help, you should contact a lawyer. You may be eligible for our free legal services and can apply by calling our Covid Legal Hotline at 1-844-244-7871 or applying online here.