Almost 1 in 3 adults in the U.S. have some kind of criminal record.

Because the record can affect your ability to get a job, most states allow it to be sealed after a period of time. This removes it from public records, though police and certain government searches can still find it. In Louisiana this is called “expungement.”

About a dozen states so far have laws that automatically seal completed records. Not Louisiana.

In Louisiana many records cannot be expunged. Expunging usually costs $550 or more. It can be complicated and can take many months.

There is a Louisiana law that courts should not charge the costs for this or should not charge them in advance. La. C.Cr.P. Art. 983. But not many attorneys have been using it and the courts may not know about it.

If you live in Jefferson Parish and have a Jefferson Parish record needing expungement, SLLS may be able to help with the court costs if it has grant funds available and you are eligible for our free legal services; call (504) 529-1000, ext. 287 to find out.

If you can pay the court costs yourself, the Justice & Accountability Center of Louisiana, at www.jaclouisiana.org, may be able to help you fill out the court’s expungement forms, and explain the court process to you. JACLA has free clinics where you can get help to go through the process on your own.

If you think you need legal representation in court, you are welcome to apply for our free legal services at www.slls.org, to see if you are eligible.

For more information about what other states have done for Americans with criminal records, to help them get jobs and ease the process, see https://ccresourcecenter.org

From the Executive Director May is Older Americans Month and this year’s theme is “Communities of Strength.” Senior citizens have been one of the highest risk groups throughout the COVID-19 pandemic, not only for contracting the coronavirus, but for falling victim to schemes seeking to take advantage of vulnerable people. SLLS provides a range of legal services aimed to protect senior citizens. Our attorneys assist seniors with legal issues like foreclosure prevention assistance with reverse mortgage lenders, wills/successions, and consumer problems like scams that threaten their financial security. We also bring legal education to libraries across our service areas to make information accessible to seniors who are not tech savvy. With access to the civil legal aid when they need it most, our seniors can remain strong and resilient members of the community.

Laura Tuggle Executive Director

SLLS Helps Senior Citizens Get Stability

Roberta, a senior citizen undergoing cancer treatment, got behind on her mortgage and was facing foreclosure. By the time she was referred to SLLS for help, it was almost too late. The mortgage lender had hired their own attorney, and added thousands of dollars in extra fees to her debt. Her SLLS attorney acted quickly to begin the process to reinstate her mortgage. With our help, she was approved for $10,000 in mortgage assistance from Catholic Charities. Through the swift and diligent work of SLLS, her foreclosure was prevented. Now Roberta can focus on her health recovery in her own home.

Lionel, a 70-year-old man living in a homeless shelter, reached out to SLLS for assistance getting access to his social security benefits. With no permanent address or phone number he was unable to get a debit card. His attorney tried to submit documentation, so he could access the funds, but the bank would not accept the shelter address. Because he was too frail to travel by bus alone, his attorney took him to the bank. They discovered he already had an account and that $1,830 was being deposited into his account monthly. He had over $10,000 saved and had no idea it was there! Since he had not been receiving any mail at the homeless shelter, he had lost track of the account. With this income and savings he’ll be able to get out of the shelter and into permanent housing.

SLLS Wins Big at LSBA Pro Bono Publico and Children’s Law Awards

Andrea Jeanmarie

Dr. Kathleen Crapanzano

Christopher Ralston

SLLS Child in Need of Care (CINC) Unit L-R: Mary Ann Swaim, Alexandra Kamp, Rella Zaplatel, Kirby Kenny, Josephine Vanderhorst, Managing Attorney, Emily Aucoin, and Natalie Paul. SLLS was well represented at the Louisiana State Bar Association's 2021 Pro Bono Publico and Children's Law Awards! Congratulations to our Child in Need of Care Unit, Children's Law Award; Andrea Jeanmarie, managing attorney of our Westbank office, Career Public Interest Award; Dr. Kathleen Crapanzano, SLLS Homeless One Stop Legal Clinic, Friend of Pro Bono Award; Christopher Ralston, SLLS Board Member, David A. Hamilton Lifetime Achievement Award; and our Northshore Pro Bono program volunteers Patricia Bonneau, Frances Strayham, & Ana Lopez, Pro Bono Publico Awards.

SLLS Providing Services in New Sexual Assault Center

Pictured above at the Washington Parish Sexual Assault Center grand opening are SLLS staff members Paula Charles, Theresa Robertson and Camille Kinsey. SLLS will be providing legal services to survivors of domestic violence and sexual assault at the new satellite location of the Washington Parish Sexual Assault Center. An SLLS staff members will be on-site at the center on Mondays from 9 am to 4 pm. You can learn more about the center here.

New on the SLLS Blog! The SLLS blog has lots of information on changes to COVID-19 benefit programs, new tax credits, rental assistance and much more. Check it out at www.slls.org/blog.

SLLS in the News

|

*If you are a resident of Caddo, Calcasieu, East Baton Rouge, Jefferson, Lafayette, Orleans or St. Tammany Parish, you cannot apply for the statewide program and must apply directly to the program in your parish.

|

| Number of People in Your Household | Annual Household Income | Average Monthly Income |

|---|---|---|

| 1 | $24,792 | $2,066 |

| 2 | $32,424 | $2,702 |

| 3 | $40,056 | $3,338 |

| 4 | $47,676 | $3,973 |

| 5 | $55,308 | $4,609 |

| 6 | $62,940 | $5,245 |

| 7 | $64,368 | $5,364 |

| 8 | $65,796 | $5,483 |

| 9 | $67,224 | $5,602 |

| 10 | $68,664 | $5,722 |

| If you live in New Orleans, you may be able to get a deferred payment plan from Entergy, which will allow you up to a year to pay your current bill and/or your unpaid balance. You can request a payment plan by calling 1-800-368-3749 or by making the request online on your “myEntergy” account. |

If you live in Jefferson Parish, you may be able to get utilities assistance from the Jefferson Community Action Programs.

To apply, you must submit:

|

| If you live outside of Baton Rouge or New Orleans and are behind on your utility bills, your provider should be contacting you to establish a reasonable repayment plan. Please note, if your utilities provider is unable to get in contact with you, you will still be responsible for the past-due amount and your utilities may still be disconnected. Your utilities provider cannot charge you late fees or interest for bills that were unpaid from March 20, 2020 through July 16, 2020. Your provider is also prohibited from making negative credit reports for these unpaid balances. These measures, particularly about late fees, interest, and negative credit reporting, have not been established in Baton Rouge and New Orleans at this time. |

The state may drop pandemic unemployment benefits.

At least 26 states have decided to stop paying the federal unemployment that has helped millions of American workers during the pandemic. This includes $300 a week that is currently being added to unemployment checks. It also can include “PUA”—the benefits for workers who are not usually eligible for unemployment benefits (like people whose earnings are not reported on W2, people with little work history, and people caring for children due to Covid closures).

Governor Edwards will end at least the extra $300 a week in Louisiana on July 31.

There are also other reasons why your unemployment benefits may end.

Your unemployment benefits may end if you are offered a job, but refuse it.

You can lose unemployment benefits if you do not have a very good reason for refusing to accept work when it is offered to you, whether it is your old job or a new one.

If your employer calls you to return to work and you refuse, they can report you to the Louisiana Workforce Commission. The agency makes this easy for employers to do. This may disqualify you from receiving unemployment benefits. You may also have to pay back any benefits you received in the time after you refused to return to work.

You can appeal and seek representation from Southeast Louisiana if the work offer does not pay close to what you recently earned or is otherwise not “suitable” for you given your background. Call our Covid-19 Helpline at 1-844-244-7871 to apply for free legal assistance or fill out our online application here.

A job should be considered not suitable if it is not following Covid-related health and safety requirements, such as social distancing or not requiring those who may have Covid to stay home.

Your unemployment benefits may end if the Louisiana Workforce Commission determines you are and always have been ineligible for benefits.

The Louisiana Workforce Commission is going back on hundreds (and maybe even thousands) of people’s unemployment claims and determining they have always been ineligible for benefits and should not have been awarded any. In these cases, the agency is also requiring claimants to pay back all of the money they received—usually over $10,000.

The agency should not cut off your benefits without sending you a notice (a letter sent to your HIRE account or hardcopy letter to the address you have on file) and without offering you a hearing.

Southeast Louisiana Legal Services can often help on these cases, but it can take several months to get these issues corrected. You can apply for free legal assistance by calling our Covid-19 Helpline at 1-844-244-7871 or by filling out an online application here.

In the meantime, you can appeal any decision that you should not get unemployment or that you have been “overpaid.” Appeal right away to protect your rights! You only have 15 days form an agency notice to submit your appeal. Your notice will include the date you must submit your appeal by. If you miss the deadline, you will lose your right to appeal.

The letter will provide instructions on how to appeal. You can find more information on appeals here.

The hearing on your appeal may be months away.

If your unemployment benefits were stopped, SLLS may be able to help, even before the hearing. Call our Covid-19 Helpline at 1-844-244-7871 to apply for free legal assistance or fill out our online application here.

*Please note, our services are only available for residents of the following parishes: Ascension, Assumption, East Baton Rouge Parish, East Feliciana Parish, Iberville, Jefferson, Lafourche, Livingston, Orleans, Plaquemines, Pointe Coupee, St. Bernard, St. Charles, St. Helena, St. James, St. John the Baptist, St. Tammany, Tangipahoa, Terrebonne, Washington, West Baton Rouge, West Feliciana

Current as of August 10, 2021

The government offers discounted internet service for some people. You may be eligible for discounted or free internet assistance. Some programs also offer discounts for computers and tablets.

You can apply for free or discounted internet service through the Lifeline program. Eligible customers will save at least $9.25 off their monthly internet bill.

If you already receive a cell phone discount from Lifeline, you cannot also get internet service through the program. However, you may be able to get discounted Internet with a special Covid-related program (more information below). More information on cell phone assistance through Lifeline is available here.

In general, you qualify for the program if:

OR

| Number of People in Your Household | Annual Household Income | Monthly Average |

|---|---|---|

| 1 | $17,388 | $1,449.00 |

| 2 | $23,517 | $1,959.75 |

| 3 | $29,646 | $2,470.50 |

| 4 | $35,775 | $2,981.25 |

| 5 | $41,904 | $3,492.00 |

| 6 | $48,033 | $4,002.75 |

| 7 | $54,162 | $4,513.50 |

| 8 | $60,291 | $5,024.25 |

| For each additional person, add | $6,129 | $510.75 |

To apply for the program, you will need to complete an eligibility form.

When you apply, you will need to provide:

If you are approved, you will be sent an eligibility certificate. You will present this to a provider that accepts the Lifeline discount to get your discounted Internet service.

Yes. The federal government has created the Emergency Broadband Benefit program. The program will provide:

The benefit is available to eligible new or existing customers of participating companies, (listed below) but there is a limit of one discount per household.

You can also combine these benefits with other Lifeline benefits. For example, an eligible household could have a Lifeline discount for their cell phone service and can also get discounted Internet with this new program.

A household is eligible if at least one member of the household meets at least one of the criteria below:

A household is a group who lives together and share money. If you don’t live together or don’t share money, more than one person under the same roof may qualify for a discount (i.e., roommates who do not share money, seniors in assisted-living homes, or students who receive Pell Grants and don’t live with their parents).

No. The program will send your benefits to your Internet provider every month.

No. You automatically qualify for it. But must still enroll to get it. Talk to your provider to to learn how to start receiving this discount. You can receive both Lifeline benefits and this new program at the same time. You can choose to use the new benefit with your current Lifeline service provider or switch to another company.

If you are not enrolled in the Lifeline benefit program, you will need to apply in one of three ways:

When you apply, you will need to provide:

If you qualify, households must contact a participating provider to select an Emergency Broadband Benefit eligible service plan.

The broadband help will end at a date not yet known. It will be based on when funds run out or when the pandemic improves enough.

Reserve Telephone Company (RTC)

If you have more questions, go to www.GetEmergencyBroadband.org or contact the Emergency Broadband Support Center at (833)511-0311.

The federal government has opened applications for the Covid-19 Funeral Assistance Program. The program will help cover funeral costs from after January 20, 2020 for those who died from Covid.

There is no deadline to apply to the program, but you should apply as soon as possible.

Who is eligible for funeral assistance?

The program will reimburse up to $9,000 per funeral. (For example, if you had to pay for two funerals since January 20 for loved ones who passed due to Covid, you may be eligible to be reimbursed for up to $18,000.)

Expenses that the program will cover include:

Other information you will need to submit:

You can apply by calling 844-684-6333 or 800-462-7585 from 8:00 am-8:00 pm CT. No online applications will be accepted.

The program is receiving a lot of calls, so it may take some time for you to talk to an agent.

Once you talk to an agent to complete your application, you will be given an application number.

After you get your application number, you will submit your documents by either:

You cannot submit your documents until your application is complete and you have an application number.

Applicants may receive assistance for the funeral expenses of multiple individuals.

Assistance is limited to a maximum of $9,000 per funeral and a maximum of $35,500 per applicant per state, territory, or the District of Columbia.

FEMA will generally only provide assistance to one applicant per deceased individual.

If more than one person helped with funeral expenses, they must register with FEMA under the same application as the applicant as a co-applicant. If not, the funds will go to the first applicant that submits all required documentation. No more than one co-applicant can be included on an application.

Yes. If you recently applied for FEMA assistance for home and/or personal property damage from a disaster, you can still apply for the Funeral Assistance program, if you meet the eligibility requirements.

It is possible to change or amend a death certificate. This process starts with contacting the person who certified the death. Their name and address is on the death certificate. You’ll likely be asked to present evidence to them to sow why the death was related to Covid.

If you are approved assistance, you will receive a check by mail or funds by direct deposit, depending on which option you chose when applying for assistance.

You have 60 days from the date of the decision letter to upload, fax or mail a signed letter appealing FEMA's decision.

The appeal should include the following:

Please be sure to review the decision letter you received for all instructions.

BEWARE OF SCAMS! FEMA will not contact you to ask for personal information unless you have applied for assistance. Do not disclose information such as the name, birth date or social security number of any deceased family member to any unsolicited telephone calls or e-mails from anyone claiming to be a federal employee or from FEMA.

If you believe you’ve been contacted by a scammer, hang up and report it to the FEMA Helpline at 800-621-3362.

El moratorio hecho por los Centros para el Control y la Prevención de Enfermedades (CDC) sobre ciertos desalojos se extiende hasta el 30 de junio de 2021. Todavía puede ser desalojado por algunas razones que no sean razones por el impago del alquiler.

Para calificar para la protección debe llenar un formulario de declaración y proporcionarlo a su arrendador. Para conseguir el formulario solo haga clic aquí.

Es importante que tenga todas las copias sobre su desalojo aguardado. Aunque llene su declaración, todavía necesita ir a la corte para presentar su declaración del moratorio hecho por el CDC.

Declaraciones hechos en otros idiomas se pueden encontrar aquí.

Si necesita asistencia legal de cómo aplicar para esta ayuda, usted puede llamar los siguientes números:

Puede ser que usted también es elegible para asistencia de renta. El gobierno federal ha proveído el estado de Luisiana con millones de dólares para asistencia de renta. Puede ser que usted es elegible si usted ha perdido ingresos por razones relacionadas a COVID-19 y la asistencia puede cubrir hasta 12 meses de renta debida por usted mas 3 pagos de renta prospectiva (dependiendo de donde usted aplica). Usted debe de aplicar pronto.

Otros Programas:

¿Cuándo fue que la orden hecha por el CDC se hizo efectivo?

La orden fue hecho efectivo el 4 de Septiembre del 2020.

¿Cuáles propiedades está cubierta por este orden?

La orden hecha por el CDC se aplica a todas las propiedades de alquiler residencial. Pero sólo ciertas personas están protegidas.

Esto es diferente de la moratoria de desalojo anterior de la Ley CARES, que se basó en si la propiedad tenía una hipoteca respaldada por el gobierno federal o un subsidio federal. La orden hecha por el CDC no se aplica a las propiedades de alquiler comercial (por ejemplo, las empresas). La orden del CDC tampoco se aplica a los desalojos de hoteles y moteles.

¿Cuáles inquilinos están protegidos por esta orden?

Una persona es una "persona cubierta" bajo la orden si le dan a su arrendador una declaración bajo pena de perjurio que:

Aquí esta una copia de la declaración en inglés. Haga clic aquí.

Recuerde que es un crimen mentir debajo de una declaración de perjurio.

¿Hay que notariar la declaración?

No. Es jurado, así que si lo firmas pero no se aplica a ti, puedes ser procesado por perjurio debido al lenguaje en el formulario.

¿Qué desalojos están cubiertos?

Los desalojos por impago de alquiler están cubiertos. Todavía puede ser desalojado por:

¿Todavía puedo ser desalojado porque mi contrato de arrendamiento ha caducado?

La orden no dice si usted puede ser desalojado porque su contrato de arrendamiento ha expirado y el propietario quiere posesión. Un juez tendrá que decidir este tema a menos que los Centros federales para el Control y la Prevención de Enfermedades (CDC) aclare este tipo de situación.

Todavía tendría que cumplir con los demás requisitos de la declaración. Si usted es desalojado por no renovación de arrendamiento, podría ser importante que un abogado familiarizado con la orden hecha por el CDC lo represente en la corte. (Llame al número anterior para ver si SLLS puede proporcionarle ayuda legal gratuita).

¿Cuándo debo dar mi declaración a mi arrendador?

Usted debe proporcionar el formulario a su arrendador tan pronto como sea posible. La orden no proporciona una fecha límite, siempre y cuando sea antes de que usted sea desalojado físicamente de su hogar.

¿Cómo debo dar mi declaración a mi arrendador?

Usted debe mantener algún tipo de prueba para cualquier tribunal que usted dio la declaración a su arrendador. Por ejemplo, puede:

¿Puedo darle algo a mi arrendador para explicar la importancia del formulario?

Estos son algunos recursos útiles que explican el moratorio de desalojo hecho por el CDC que usted puede usar:

¿Qué pruebas necesito para respaldar la declaración?

Usted debe esperar que los jueces o su arrendador puedan hacerle preguntas sobre la declaración, por lo que debe estar preparado para llevar lo siguiente a los tribunales si el arrendador presenta o ha solicitado un desalojo:

¿Qué pasa si mi casero ya tiene una sentencia de desalojo, pero todavía estoy en mi apartamento porque el alguacil aún no ha salido?

Si el desalojo fue por impago de alquiler está protegido, SOLO si rápidamente usted dio el paso de convertirse en una "persona cubierta" dando la declaración a su arrendador.

Así que asegúrese de proporcionarlo de inmediato. Después usted debe llamar al tribunal y al alguacil para proporcionar pruebas de que usted dio la declaración para parar el desalojo. Si esta es su situación, debe considerar ponerse en contacto con un abogado de inmediato. Usted puede calificar para recibir asistencia legal gratuita de Southeast Louisiana Legal Services al (504) 529-1000 x.223.

Aquí está el formulario de Declaración de los CDC.

La orden actualizada por el CDC y la orientación hecha por el CDC lo protegen explícitamente incluso si proporciona la orden después de recibir una sentencia de desalojo, pero antes de ser eliminado físicamente de la propiedad.

¿Puede mi arrendador seguir presentando un desalojo en mi contra?

Sí, su arrendador todavía puede presentar un desalojo en su contra por impago de alquiler o cualquier otra razón. Si usted cree que está cubierto por la orden de los CDC, todavía debe ir a la corte si recibe un aviso de desalojo para probar al juez que usted es una "persona cubierta" bajo la orden.

¿Mi alquiler aún debe pagarse?

Sí, su alquiler aún vence, y su arrendador puede cobrarle cargos por mora si no paga. Su arrendador puede demandarlo para cobrar una deuda de alquiler, o puede reportar cobros que podrían afectar su crédito o capacidad para obtener futuras viviendas.

Recuerde, para ser una "persona cubierta" usted debe ser capaz de declarar bajo sanción de perjurio que usted intentará hacer pagos lo más cerca posible del monto total de su alquiler dado su circunstancia financiera. Considere la posibilidad de obtener repetidamente giros postales por la cantidad de alquiler que puede permitirse. Por ejemplo, cuando reciba su cheque de desempleo, chequeo de pago o seguro social, piense en cuánto puede poner para el alquiler, incluso aunque sea una cantidad muy pequeña. Ofrezca los giros postales a su arrendador y asegúrese de obtener un recibo si son aceptados. Si tiene la capacidad de enviar un mensaje de texto o enviar por correo electrónico una foto de los giros postales a su arrendador, hazlo. Si su arrendador no acepta el pago parcial, mantenga las órdenes de dinero en un lugar seguro para que pueda mostrar a un juez que trató de hacer pagos y que todavía tiene ese dinero disponible para dar a su arrendador.

¿Y si ya le di la declaración a mi arrendador? ¿Tendré que presentar uno nuevo bajo la nueva extensión?

No. Si no se ha mudado y ya ha firmado y presentado una declaración de moratoria de desalojo, no es necesario darle a su arrendador otra.

¿Qué sucede cuando la Orden expira el 30 de junio de 2021?

Si todavía tiene alquiler no pagado el 30 de junio de 2021, su arrendador podrá desalojarlo por impago de alquiler. Su arrendador también puede demandarlo para cobrar una deuda de alquiler, o puede reportar los cobros que podrían afectar su crédito o capacidad para obtener futuras viviendas.

¿Qué pasa si le doy la declaración a mi arrendador, pero mi arrendador sigue solicitando el desalojo?

Puede solicitar servicios legales gratuitos de los Servicios Legales del Sureste de Luisiana en los números siguientes. Vea la sección "¿Qué pruebas necesito para respaldar la declaración?" anteriormente para comenzar a compilar la documentación que podría necesitar en la corte para demostrar que su arrendador no puede desalojarlo. Asegúrese de ir a la corte incluso si ya ha proporcionado la declaración a su arrendador.

El moratorio hecho por los Centros para el Control y la Prevención de Enfermedades (CDC) sobre ciertos desalojos se extiende hasta el 30 de junio de 2021. Todavía puede ser desalojado por algunas razones que no sean razones por el impago del alquiler. Para calificar para la protección debe llenar un formulario de declaración y proporcionarlo a su arrendador. Para conseguir el formulario solo haga clic aquí. Haga clic aquí para obtener más información sobre el moratorio hecho por el CDC.

La última ley de estímulo aprobada por el Congreso también proporciona ciertas protecciones y recursos para los inquilinos afectados por COVID-19:

Otros Programas:

Masks are required. Attendance is limited to maintain social distancing.

You must register online here.

With SLLS Attorney Elizabeth Harvey

Got questions about the eviction process and the eviction moratorium? Who is covered and what is the status? What about the foreclosure moratorium and does it cover me?

April 7 - 5:30 pm

West Regional Library

With SLLS Attorney Steven Reed

Should I make a Will? Do I need a Power of Attorney? How do I legally transfer titles to home and assets when a loved one passes away?

April 21 - 5:30 pm

St. Rose Branch

With SLLS Attorney Paul Tuttle

Problems with claiming the Earned Income Credit? Are you being audited? Does the IRS say you own them money?

April 28 - 5:30 pm

East Regional Library

With SLLS Attorney Michele Stross

Did someone steal your identity and you are getting bills for things you did not buy? Want to learn how to protect yourself from identity theft and consumer scams?

May 12 - 5:30 pm

West Regional Library

With SLLS Attorney Andrea Jeanmarie

Need to file for divorce if you are no longer with your spouse? Need to learn about your rights to custody or your child or a child you may be raising?

June 9 - 5:30 pm

St. Rose Branch

With SLLS Attorney Michele Stross

In debt and need a fresh start? Has the impact of COVID made it impossible for you to pay your bills? How can you protect your assets from garnishment?

June 23 - 5:30 pm

West Regional Library

West Regional Library:

105 Lakewood Dr.

Luling, LA 70070

St. Rose Branch:

90 East Club Dr.

St. Rose, LA 70087

East Regional Library:

160 West Campus Dr.

Destrehan, LA 70047

In order to qualify for this protection you must fill out a declaration form and provide it to your landlord. You can download a copy of the declaration form in English here.

Be sure to keep a copy for your records. If you receive an eviction notice you still need to go to court to show the judge that you provided the declaration.

Declaration forms in other languages are available here: https://nlihc.org/coronavirus-and-housing-homelessness/national-eviction-moratorium

If you need legal advice on how this order may apply to you, contact:

You may also be eligible for rental assistance. The federal government has provided the state of Louisiana with millions of dollars for rental assistance. You qualify if you have lost income due to COVID-19, and they can pay up to 12 months of back rent plus up to 3 months prospective rent (depending on the program). Apply as soon as possible:

Other programs that may be able to provide assistance:

The order took effect on Friday, September 4, 2020.

The CDC order applies to all residential rental properties. But as set out below only certain people are protected.

This is different from the earlier CARES Act eviction moratorium, which was based on whether the property had a federally backed mortgage or federal subsidy. The CDC order does not apply to commercial rental properties (for example, businesses). The CDC order also does not apply to evictions from hotels and motels.

A person is a “covered person” under the order if they give their landlord a declaration under penalty of perjury that:

1. The individual has used best efforts to obtain all available government assistance for rent or housing;

2. The individual either

3. The individual is unable to pay the full rent or make a full housing payment due to substantial loss of household income, loss of compensable hours of work or wages, a layoff, or extraordinary out-of-pocket medical expenses;

4. The individual is using best efforts to make timely partial payments that are as close to the full payment as the individual’s circumstances may permit, taking into account other necessary expenses; and

5. Eviction would likely render the individual homeless—or force the individual to move into and live in close quarters in a new congregate or shared living setting— because the individual has no other available housing options.

The declaration containing the required language is available for download here.

*Remember that it is a criminal offense to lie on a declaration under penalty of perjury!

No. It is sworn, so if you sign it but it does not apply to you, you can be prosecuted for perjury because of the language on the form.

Evictions for non-payment of rent are covered. You can still be evicted for:

The order does not say whether you can be evicted because your lease is expired and the owner wants possession. A judge will have to decide this issue unless the federal Centers for Disease Control and Prevention (CDC) clarifies it.

You would still have to meet the other requirements on the declaration.

If you are evicted for lease non-renewal it might be important to have an attorney familiar with the CDC order represent you in court. (Call the number above to see if SLLS can provide you with free legal help).

You should provide the form to your landlord as soon as possible. The order does not provide a deadline, as long as it is before you are physically evicted.

You should keep some form of proof for any court that you gave the declaration to your landlord. For example you can:

Here are some helpful resources explaining the CDC eviction moratorium that you can use:

You should expect that judges or your landlord may ask you questions about the declaration, so you should be prepared bring the following to court if the landlord files or has filed for an eviction:

If the eviction was for nonpaymentof rent you are protected, ONLY IF you quickly take the step to become a “covered person” by giving the declaration to your landlord. So be sure to provide it right away. Then you must call the court and the constable to provide proof that you gave the declaration in order for them to stop the eviction. If this is your situation you should consider contacting an attorney right away. You may qualify for free legal aid from Southeast Louisiana Legal Services at (504) 529-1000 x.223.

Here is the CDC Declaration form.

The updated CDC order and guidance from the CDC explicitly protect you even if you provide the order after receiving an eviction judgment, but before being physically removed from the property.

Yes, your landlord can still file an eviction against you for nonpayment of rent or any other reason. If you believe you are covered by the CDC order, you must still go to court if you receive an eviction notice to prove to the judge that you are a “covered person” under the order.

Yes, your rent is still due, and your landlord can charge you late fees if you do not pay. Your landlord can sue you to collect a rent debt, or can report it to collections which could affect your credit or ability to get future housing.

Remember, to be a “covered person” you must be able to declare under penalty of perjury that you will attempt to make payments as close to the full amount of your rent as possible given your financial circumstances. Consider repeatedly getting money orders for the amount of rent that you can afford. For example, when you get your unemployment, paycheck, or social security check, think about how much you can put toward rent, even if it is a very small amount. Offer the money orders to your landlord and be sure to get a receipt if they are accepted. If you have the ability to text or email a picture of the money orders to your landlord, do so. If your landlord will not accept partial payment, keep the money orders somewhere safe so you can show a judge that you tried to make payments and that you still have that money available to give your landlord.

No. If you have not moved and have already signed and submitted an eviction moratorium declaration, you do not need to give your landlord another one.

If you still have unpaid rent on June 30, 2021, your landlord will be able to evict you for nonpayment of rent. Your landlord can also sue you to collect a rent debt, or can report it to collections which could affect your credit or ability to get future housing.

You can apply for free legal services from Southeast Louisiana Legal Services at the numbers below. See “What evidence do I need to back up the declaration?” above to start compiling documentation that you might need in court to show that your landlord cannot evict you. Be sure to go to court even if you have already provided the declaration to your landlord.

*Please note, our services are only available for residents of the following parishes: Ascension, Assumption, East Baton Rouge Parish, East Feliciana Parish, Iberville, Jefferson, Lafourche, Livingston, Orleans, Plaquemines, Pointe Coupee, St. Bernard, St. Charles, St. Helena, St. James, St. John the Baptist, St. Tammany, Tangipahoa, Terrebonne, Washington, West Baton Rouge, West Feliciana

From the Executive Director It is hard to believe ta year has passed since the start of the COVID-19 pandemic. We have not seen a period of sustained crisis like this since Hurricane Katrina and we know it is still far from over. Our clients are still struggling, with our caseload still increasing, yet the outlook is far from hopeless. As challenging as navigating the pandemic has been, we have been able to continue to provide exceptional service to our clients. Our legal advocacy wins have achieve impacts far beyond individual clients served. Our direct casework helped obtain or preserve over $22 million in benefits for our clients. We’ve innovated our outreach delivery to reach more people in safe ways with in-person outreach resuming in April 2021 with strict adherence to COVID protocols.

Thank you for your continued support in the fight for fairness.

Laura Tuggle Executive Director

SLLS Clients and Staff Featured in TIME Documentary New Orleans based filmmaker Kathleen Flynn followed two SLLS clients, Ronda Favre and Dominique King, both African-American single mothers who lost their jobs in the hospitality industry, as they faced the dire prospect of being evicted in the middle of the COVID-19 pandemic. Their SLLS Attorneys, Hannah Adams and Alexis Erkert, are also featured in the piece, highlighting the uphill battle our attorneys have faced trying to keep families in their homes and the disproportionate impact on women of color during the pandemic.

Looking Back at SLLS COVID-19 Response

Our online outreach has been hugely successful in connecting the community with the resources they need. We had over 25,000 Facebook Live views and nearly a million views on our website.

Our COVID-19 hotline has received over 15,000 calls, and streamlined our processes to make it easier for clients to get the help that they need in a crisis.

As a result of our advocacy to keep our clients safe from COVID-19 exposure, several courts modified their processes for remote hearings and ADA accommodations.

At the start of the pandemic, Jefferson Parish Juvenile Court stopped hearing child abuse cases, leaving vulnerable children at serious risk of abuse and neglect. SLLS successfully advocated to the LA Supreme Court for these critical hearings resume.

For Our Clients, The Crisis is Far From Over

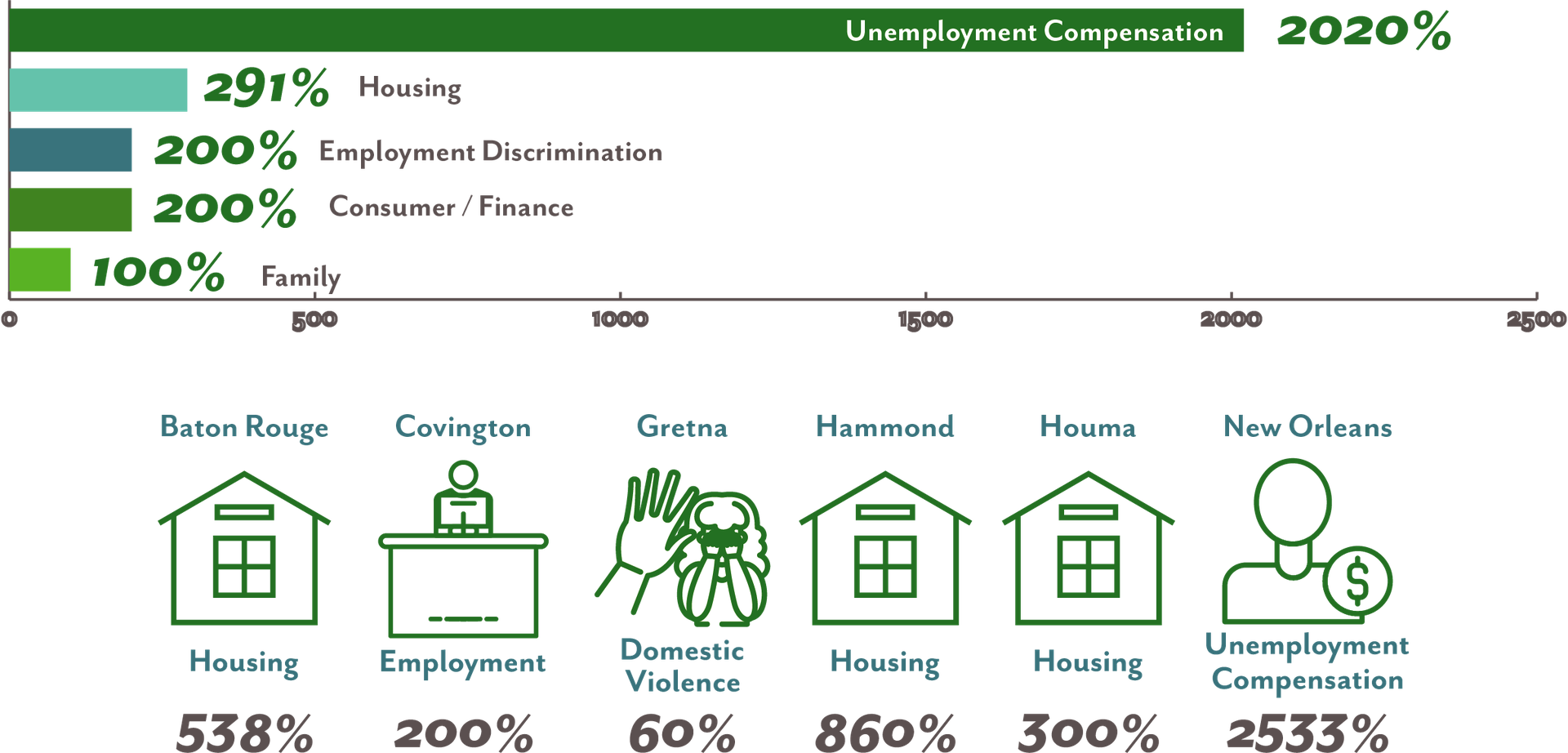

Nearly a year into the COVID-19 pandemic, we're still seeing huge increases in the need for legal services. We've seen an over 2000% increase in unemployment compensation cases compared to the two months prior to the outbreak and despite the CDC eviction moratorium and rental assistance programs, families are still at-risk of becoming homeless as a result of eviction.

Coming Soon!

Give NOLA Day - May 4, 2021

All funds raised will support our ongoing COVID-19 Legal Relief Efforts.

SLLS in the News

|

Yes. Unemployment benefits are like wages, and you must report it as income on your tax return if you earned enough income to need to file taxes. BUT, the first $10,200 of unemployment benefits you received is not taxable by the IRS. If you received more than $10,200 in unemployment benefits, that will be taxed.

Yes. The Louisiana Workforce Commission (LWC) has begun the process of mailing out a 1099-G form to everyone who received unemployment benefits in 2020.

You can also get a copy online by logging into your HIRE account at louisianaworks.net.

If you have access to your HIRE account, you may want to look at your “Claim Summary” page to see the benefits you have been paid out throughout the weeks you have filed. Both your weekly benefit amount and your additional Loss Wage Assistance, (previous additional $300 weekly amount in August), and Federal Pandemic Unemployment Compensation, (previous $600 weekly benefit amount), are counted as benefits paid to you.

However, this option may not be helpful if you have received benefits under several unemployment programs in 2020. This is because Claimants often have their claim summary page refreshed, for example, when filing a new claim for an extension of benefits or consideration of another benefit program.

If you think the amount of benefits listed in your 1099-G is incorrect, you can contact the Unemployment Call Center at 866-783-5567 and request a “paper review.”

If an error is identified, the agency will take make the necessary corrections and issue a corrected 1099-G.

Maybe. If the issue is corrected before the filing deadline then you will want to wait until your receive your corrected 1099-G form.

But if the problem has not been corrected, the IRS advises that you may still file your federal income tax return, but to NOT place the amount that is listed in your 1099-G form. You will simply file your return without reporting your 1099-G information and you will need attach a statement to your tax return.

The statement will need to include why you are not reporting the 1099-G income. A copy of the confirmation you will receive from the LWC’s online fraud reporting form can serve as the written statement.

You can report fraud using the forms that the Agency has provided here. You can also call 1-800-201-3362.

The agency encourages that you only submit this form once. You receive a confirmation email with more information on the next steps. This form can be if you received a 1099-G in error and you have not claimed any unemployment benefits in 2020.

The agency suggests that you should submit the Identity Theft request again at the following link: https://www2.laworks.net/Forms/UI_ReportSuspectedFraudForm.asp

Saving the confirmation that you have submitted a request for Identity Theft and other report for fraud is important. Proof of these requests and reports can be helpful for tax purposes.

Other ways to report fraud:

The Louisiana Workforce Commission is required by the IRS to put all benefit payments, including overpaid amounts on your 1099-G form. These benefits were paid out to you by the Agency and they will not issue a corrected 1099 if:

No. These benefits have been paid to you in 2021 and not 2020. The Agency will need to report this information to the IRS next year for your 2021 income tax return and such amounts will be included in your 2021 1099- G form.

You may continue to use the original 1099-G form that was sent to you.