The information provided on this post does not, and is not intended to, represent legal advice. All information available on this site is for general informational purposes only. If you need legal help, you should contact a lawyer. You may be eligible for our free legal services and can apply by calling our Covid Legal Hotline at 1-844-244-7871 or applying online here.

What if information against me on my report is true?

If there is true information on your report that is bad for you, credit bureaus can usually only report for 7 years. They can report bankruptcy information for 10 years.

What if information on my report is not true?

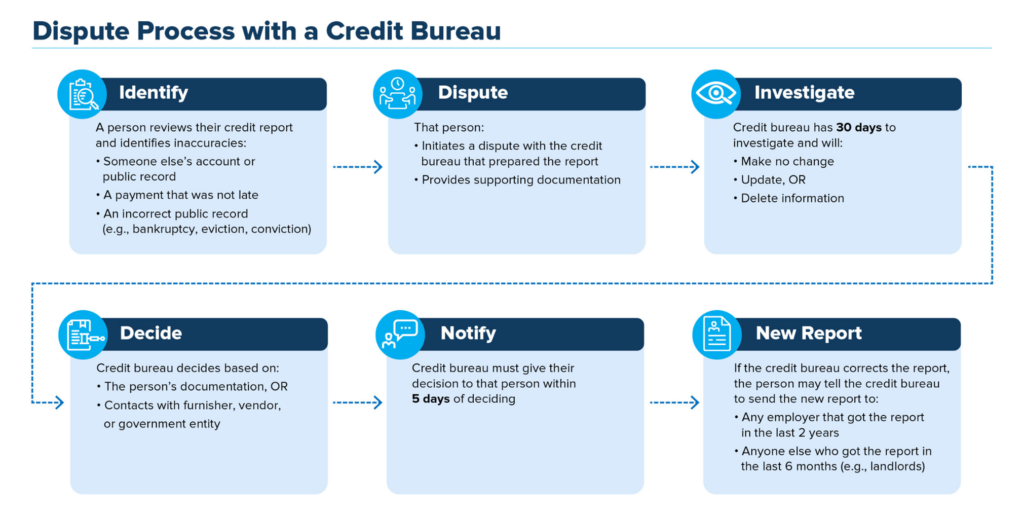

If something is not true is on your credit report, you should contact the credit bureau(s) that list the mistake(s) and the business(es) it is listed for. The page here tells how to do it. Here’s how. Contacting them to say that the report is wrong is called a “dispute”.

After you contact them to say it is wrong, credit bureau(s) must check what you question within 30 days, unless they decide that your dispute is frivolous. If they find it frivolous, they must give you a reason. Sometimes this may be that you need to give them more evidence. The credit bureau(s) will forward your evidence to the business(es) that gave the information. The business(es) then must check and report back to the credit bureau(s).

If the credit bureau agrees with you after these steps your dispute is called “resolved”. If this happens, the credit bureau must tell you in writing and give you a free credit report. This does not count as your free annual report.

You can also ask that the credit bureau send notices of the correction(s) to anyone who got your report in the past six months and to anyone who got a copy for job purposes during the past two years. If you ask, the credit bureau must send the updated reports.

If the credit bureau does not agree with you after it checks, you can ask that your credit reports say that you disagree with the information. (This is called a “statement of dispute”). Also, you can ask that the credit bureau give your statement to anyone who got a copy of your report recently, but you can be charged a fee for this.

What to Do if a Company Takes Action Against You because of Your Credit Report

You can ask within 60 days of when someone denies you credit, a rental, insurance, a jog, or hurts you in some other way because of your credit report and can get another free credit report. The company must send you a notice that includes the name, address, and phone number of the credit bureau that they used You request the free credit report from that credit bureau.

You are also entitled to another free report each year if:

- you’re unemployed and plan to look for a job within 60 days

- you’re on welfare

- your report is inaccurate because of fraud, including identity theft

Repairing Your Credit

You may be thinking about hiring a company to help investigate mistakes on your credit report and to “repair” your credit. But anything a credit repair company can legally do, you can do for yourself at little or no cost. If you hire a credit repair company, it is important to know your rights.

It is illegal for credit repair company to charge you before they help you. It is illegal for credit repair companies to lie about what they can do for you. Credit repair companies also must explain:

- your legal rights in a written contract that also details what they will do for you;

- that you have a right to cancel for three (3) days without any charge, and give you a written cancellation form;

- how long it will take to get results

- the total cost you’ll pay

- any guarantees

If you choose not to hire a credit repair company, you can rebuild your credit by:

- paying your bills by the due date;

- paying off outstanding debt;

- not taking on new debt.

If you are in debt and need help, you might get help from a reputable credit counseling organization. For a list of approved credit counseling agencies, click here.

Credit Repair Scams

You are dealing with a credit repair scam if a company:

- insists you pay it before it helps you

- tells you not to contact the credit bureaus directly

- tells you to dispute information in your credit report you know is accurate

- tells you to lie on your applications for credit or a loan

- doesn’t explain your legal rights when it tells you what it can do for you

If a company promises to create a new credit identity or hide your bad credit history or bankruptcy, it’s a scam. These companies often use stolen Social Security numbers or get people to apply for Employer Identifications Numbers from the IRS under false pretenses to create new credit reports. If you use a number other than your own to apply for credit, you won’t get it, and you could face fines or prison.

If you have a problem with a credit repair company, report it to:

- your state attorney general or local consumer affairs office. Many states have their own laws covering credit repair companies.

- the FTC at ftc.gov/complaint or 1-877-FTC-HELP. The FTC can’t resolve individual credit disputes, but it can take action against a company for breaking the law.