Stimulus Payments For SSI, Social Security, AND VA Recipients

Posted on: May 1, 2020

The information provided on this post does not, and is not intended to, represent legal advice. All information available on this site is for general informational purposes only. If you need legal help, you should contact a lawyer. You may be eligible for our free legal services and can apply by calling our Covid Legal Hotline at 1-844-244-7871 or applying online here.

STIMULUS PAYMENTS FOR SSI, SOCIAL SECURITY, AND VA RECIPIENTS

Updated October 7, 2020

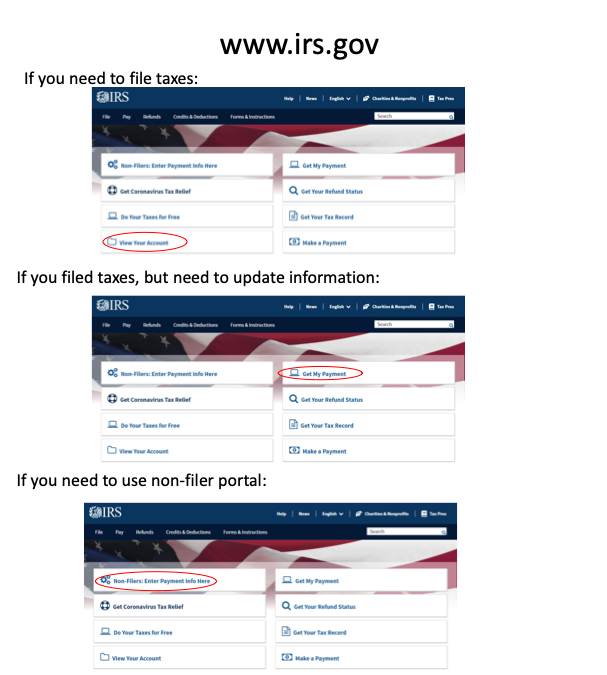

[AN UPDATED FLOWCHART WILL BE ADDED SOON]

*Important Deadline to Note:

If you are eligible to use the non-filer portal, the deadline to claim your stimulus payment has been extended until November 21, 2020. The non-filer portal is designed for people with incomes typically below $24,400 for married couples, and $12,200 for singles who could not be claimed as a dependent by someone else.

What can go wrong?

1. DO NOT USE NONFILER PORTAL IF YOU FILED TAXES IN 2018 OR 2019. This may cause problems with the IRS and may delay your check.

2. AVOID SCAMS: There are many scammers out there trying to take people’s Stimulus checks. Some people may phone you, promising your Stimulus check, trying to get your bank account or debit card information or other things they can use to steal your money. Government agencies will never call you about the Stimulus checks. Never give bank, debit card, or Social Security information to anyone who calls you.

3. DO NOT PUT THE MONEY INTO A BANK ACCOUNT

THAT HAS A GARNISHMENT ORDER AGAINST IT. After a court judgment that someone owes a debt, the court can order the money can be taken from the debtor’s bank account. SSI money cannot be taken even if there is an order like this. But the stimulus money can be taken. Be sure not to give the IRS deposit information for an account of yours or someone else’s that is being “garnished.” If your account is garnished, you may want to wait much longer to get a paper check.

4. Some SSDI beneficiaries may need to file taxes; in limited circumstances they are considered taxable.

DO NOT PAY ANYONE TO HELP YOU GET THE STIMULUS CHECK. This could take most of your money (or even all of it). As noted above, there are free ways to do what you need on the IRS website, and a free organization to help.

A new phone number was created for Economic Impact Payments. Taxpayers can call 800-919-9835, between the hours of 7:00 AM and 7:00 PM local time, with questions related to the payment. Taxpayers may also refer to www.irs.gov/coronavirus tax relief and economic impact payments for additional information.

Southeast Louisiana Legal Services is a nonprofit law firm whose mission is to achieve justice for low-income people in Louisiana by enforcing and defending their legal rights through civil legal aid, advocacy, and community education. We provide free legal help to low-income people in a variety of civil legal matters including divorce, custody, tax, consumer, foreclosure, bankruptcy, unemployment benefits, housing, public benefits, and more.

You can find more information at slls.org.